Service

Marijuana Tax

A marijuana sales tax is a tax collected on the sale of recreational and medicinal marijuana products. This tax is typically a percentage of the retail price and is charged at the point of sale. Payments are due on or before 30 days after the end of the Quarter Due. For more information please review the Borough Marijuana Sales Tax Code.

Marijuana Tax is collected quarterly. Each retail Marijuana Facility is required to complete a self reported Marijuana Tax Quarterly Return. Payments are due 30 days from the last day of the reporting quarter.

A Certificate of Registration Application is required before operations may commence.

Go to the Marijuana Facility Permit

| Quarter | Due Date |

|---|---|

| Quarter 1 – January through March | Due on or before April 30 |

| Quarter 1 – April through March | Due on or before July 30 |

| Quarter 1 – July through September | Due on or before October 30 |

| Quarter 1 – October through December | Due on or before January 30 |

Current Rates

| Location | Rate |

|---|---|

| Outside of City Limits | 5% |

| Houston | 3% |

| City of Palmer | 2% |

How to setup your account

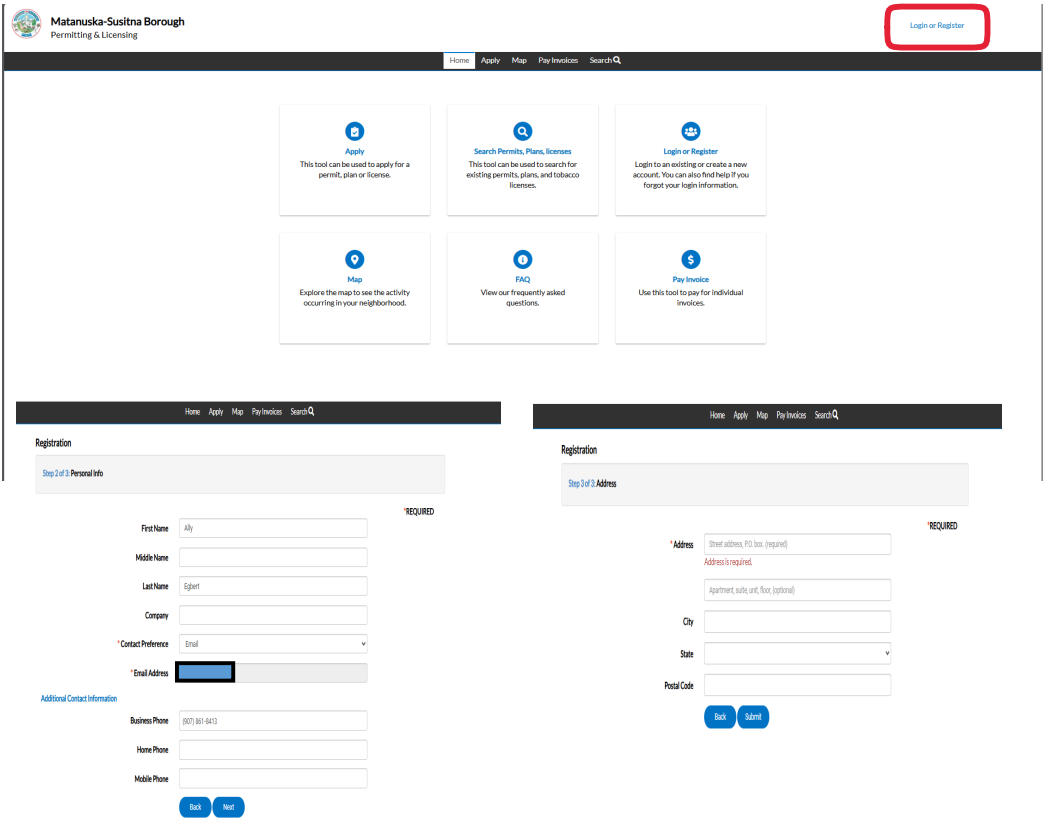

Go to the payment portal

Navigate to our online Payment Portal.

Login/Register

- Click on Login or Register in the top right corner of the screen

- Fill out the required information. Note: Use the email we have on file for you. Your email links you to your business that is already in the system.

- If you need to update your email please give us a call.

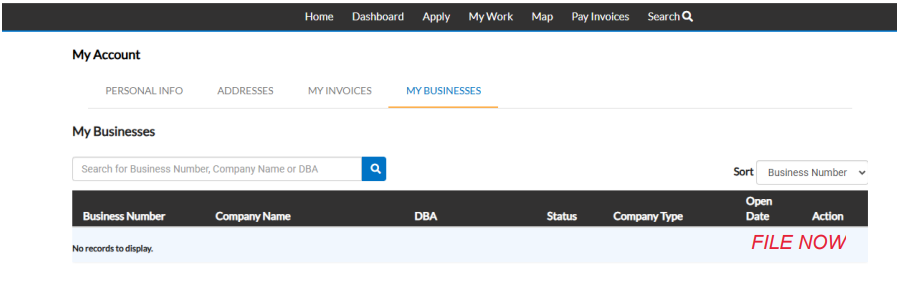

Go to your business

- Once your account is setup, you can locate your business under your name. This will show any business tied to your email address.

- When it's time to file your quarterly taxes, next to your business it will say "file now". The quarters are set up in the back office and can only be done one quarter at a time.

-

This program will allow you to have access to your filing history, uploaded documents, and any permits or licensing.

-

Export and get comfortable using the system so you are ready for the next filing.

Pay in Person

Go to the DSJ Building

Go to the Main Borough Building located at 350 E. Dahlia Ave. in Palmer.

Speak to the front desk in the main lobby

Once you get here, enter through the main entrance into the main lobby and speak to the front desk. Let them know why you're here and they will help you from there.

Pay by Mail (Check Only)

Gather all required information

Make sure to include all relevant contact information, account information, along with the form etc

Send the Check

Address the check to

Matanuska-Susitna Borough Finance,

350 E Dahlia Avenue, Palmer, AK 99645

Pay via Drop Box (Check Only)

Go to one of our drop box locations.

There are three locations:

Station 6-1 101 W Swanson, Wasilla, AK, 99654

Station 6-5 680 N. Seward-Meridian Parkway, Wasilla, AK, 99654

Main Building: 350 E Dahlia, Palmer, AK 99645

Leave the check in the drop box

Once you reach the location you can drop your check in the secure drop box.