Service

Real Property Tax

The borough assesses a real property tax based on property values. There is an assessment & appeals period in February of the year. Taxes are billed July 1st and due either in full on the first installment date, or split into the two installments listed below.

| Due Date | Installment |

|---|---|

| August 15, 2025 | First Installment |

| February 17, 2026 | Second Installment |

You can view your property tax information by looking up your address in MyProperty.

Curious about how taxes work, and where the money goes? We have summarized how Borough finances work in our annual Popular Annual Financial Report.

Pay online (Card)

Pay Online

Navigate to our online payment portal

Pay Online (ACH)

Note:

You may pay property tax online by echeck. There is a $1 transaction fee.

Gather your account information

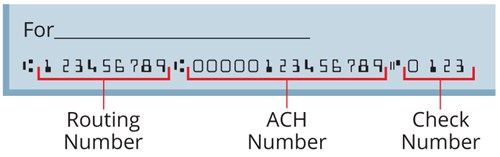

eCheck Account & Routing Number - you MUST enter your full account number or your payment may be rejected and subject to NSF fees.

Note: If property is in foreclosure status, payment cannot be made online. Only certified funds or cash can be accepted on foreclosure properties.

Pay online

Navigate to our online Personal Property Taxpayment portal

Pay in Person

Go to the DSJ Building

Go to the Main Borough Building located at 350 E. Dahlia Ave. in Palmer.

Speak to the front desk in the main lobby

Once you get here, enter through the main entrance into the main lobby and speak to the front desk. Let them know why you're here and they will help you from there.

Pay by Mail (Check Only)

Gather all required information

Make sure to include all relevant contact information, account information, along with the form etc

Send the Check

Address the check to

Matanuska-Susitna Borough Finance,

350 E Dahlia Avenue, Palmer, AK 99645

Pay via Drop Box (Check Only)

Go to one of our drop box locations.

There are three locations:

Station 6-1 101 W Swanson, Wasilla, AK, 99654

Station 6-5 680 N. Seward-Meridian Parkway, Wasilla, AK, 99654

Main Building: 350 E Dahlia, Palmer, AK 99645

Leave the check in the drop box

Once you reach the location you can drop your check in the secure drop box.