Service

Talkeetna Area 36 Sales Tax

A 3% sales tax is applied to all retail sales and services within Talkeetna’s Service Area 36. This general tax is calculated as a percentage of the purchase price and collected by retailers at the point of sale.

For more information, including specific guidelines and exemptions, please refer to the Borough Service Area Sales Tax Code. To confirm whether a location falls within the taxable area, see the Service Area Map

| Quarter | Due Date |

|---|---|

| Quarter 1 - January through March | Due on or before April 30 |

| Quarter 2- April through June | Due on or before July 30 |

| Quarter 3- July through September | Due on or before October 30 |

| Quarter 4- October through December | Due on or before January 30 |

If you're a non-profit organization or a wholesale business, you may qualify for a sales tax exemption. Applications for exemption are available here and must be completed and submitted to the Borough for review.

Please note: tax-exempt status begins only after your application has been approved.

How to setup your account

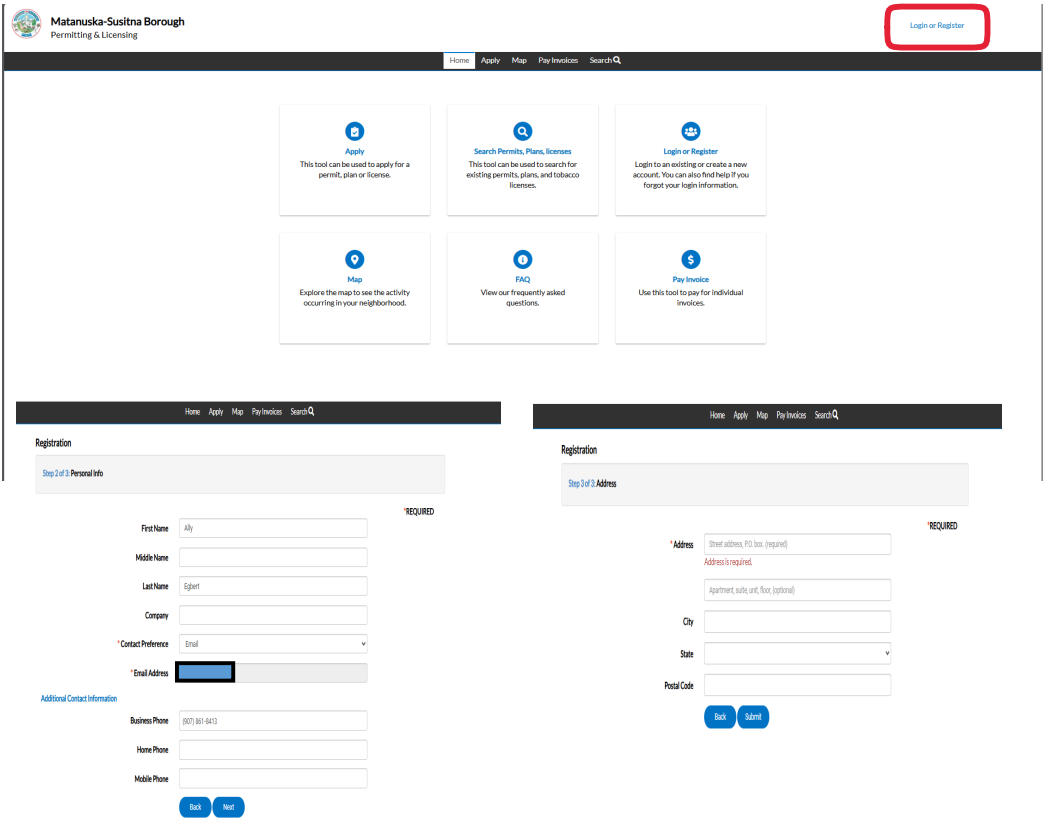

Go to the payment portal

Navigate to our online Payment Portal.

Login/Register

- Click on Login or Register in the top right corner of the screen

- Fill out the required information. Note: Use the email we have on file for you. Your email links you to your business that is already in the system.

- If you need to update your email please give us a call.

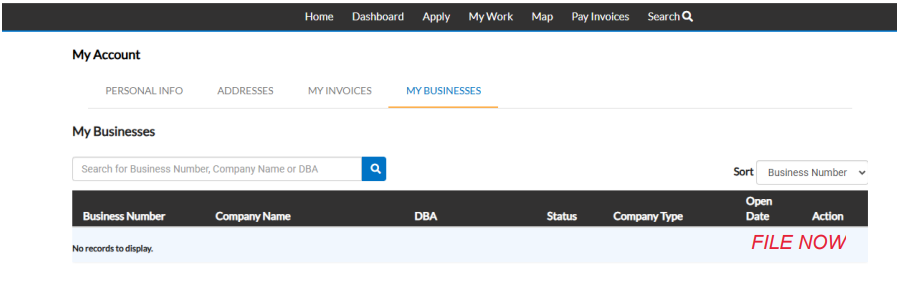

Go to your business

- Once your account is setup, you can locate your business under your name. This will show any business tied to your email address.

- When it's time to file your quarterly taxes, next to your business it will say "file now". The quarters are set up in the back office and can only be done one quarter at a time.

-

This program will allow you to have access to your filing history, uploaded documents, and any permits or licensing.

-

Export and get comfortable using the system so you are ready for the next filing.

Pay in Person

Go to the DSJ Building

Go to the Main Borough Building located at 350 E. Dahlia Ave. in Palmer.

Speak to the front desk in the main lobby

Once you get here, enter through the main entrance into the main lobby and speak to the front desk. Let them know why you're here and they will help you from there.

Pay by Mail (Check Only)

Gather all required information

Make sure to include all relevant contact information, account information, along with the form etc

Send the Check

Address the check to

Matanuska-Susitna Borough Finance,

350 E Dahlia Avenue, Palmer, AK 99645

Pay via Drop Box (Check Only)

Go to one of our drop box locations.

There are three locations:

Station 6-1 101 W Swanson, Wasilla, AK, 99654

Station 6-5 680 N. Seward-Meridian Parkway, Wasilla, AK, 99654

Main Building: 350 E Dahlia, Palmer, AK 99645

Leave the check in the drop box

Once you reach the location you can drop your check in the secure drop box.